Richard is a smallholder maize farmer in Western Kenya. He used to borrow money from his family or friends to buy essential inputs to grow maize—seed, fertilizer, and equipment—because he couldn’t access a formal loan from a bank. Most banks consider him a high risk client because of his low-income and lack of credit history. Recently though, Richard obtained a $50 loan for his farming business. By processing and analyzing satellite imagery on his farmland and cropping cycle, in combination with other alternative data, a lending organization was able to assess his creditworthiness.

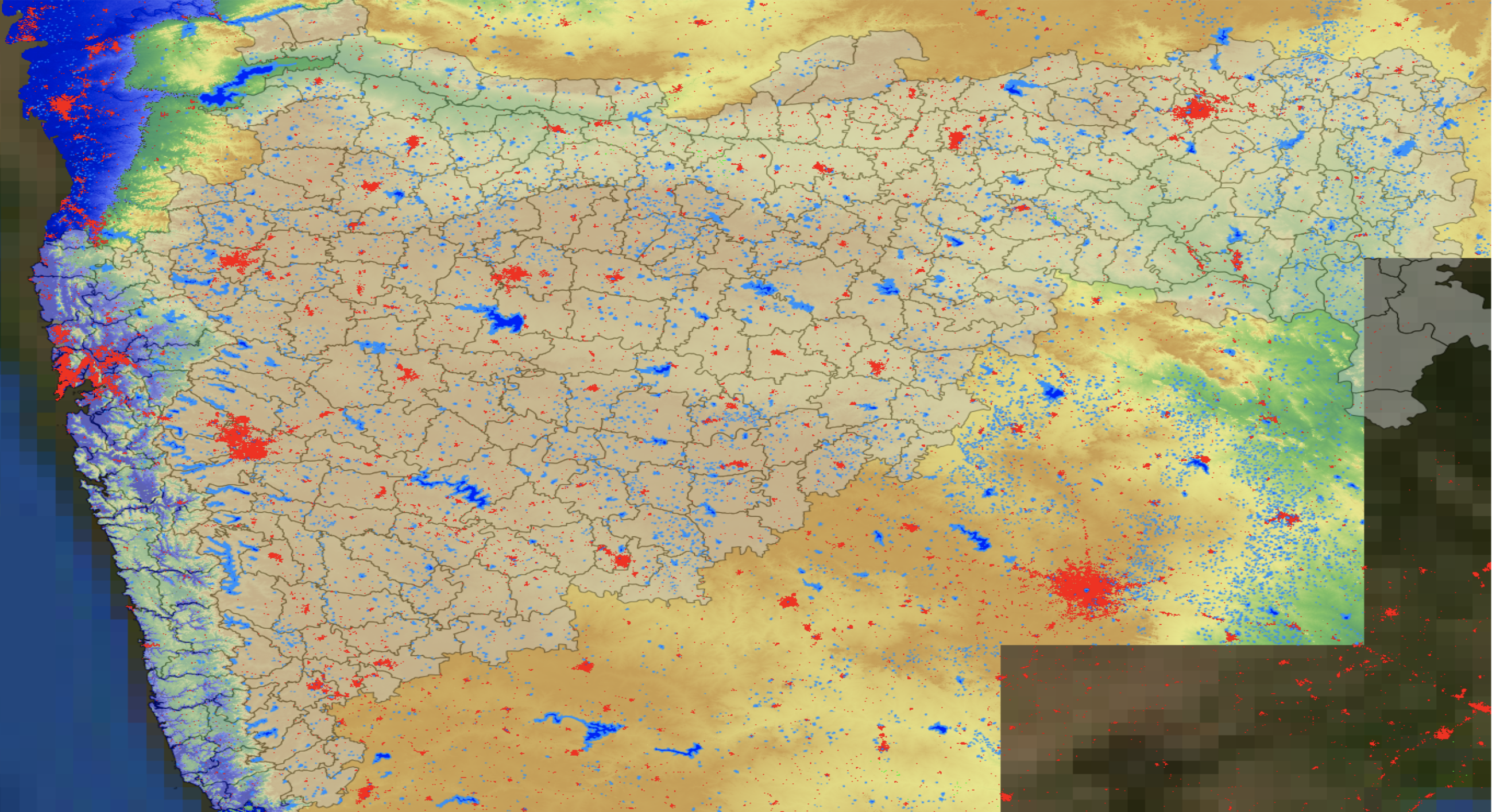

Richard’s story is not unique. Remote data captured through earth observation technology (i.e., satellite imagery) could be a game changer for insurance and lending products by reducing organizational and logistical costs. High resolution remote sensing can guide ground observations and enable organizations to estimate yield at the village level. Satellite imagery—in combination with demographic, financial, agronomic, geospatial, and psychometric data—provides sufficient detail on “thin file” clients like Richard (clients without an established credit history) to make lending decisions. Innovative FinTechs like Apollo Agriculture and Harvesting Inc. are generating credit scores using algorithms that rely on mobile phone and alternative data such as earth observation imagery as well as machine learning of farmers’ needs, incentives, behaviors, and agricultural activities.

Earlier this year, FiDA spoke with Apollo and Harvesting to learn about the journeys they took to integrate satellite imagery (i.e., images captured with earth observation technology) into their business offerings and how they implemented earth observation technology. The findings highlighted in FiDA’s case study, “Launching into space: using satellite imagery in financial services,” offer financial service providers (FSPs) interested in leveraging non-traditional, alternative data two relevant paths for using earth observation technology.

What does it take to utilize satellite imagery?

The FinTechs’ findings indicate initial predictive power from satellite imagery in terms of generating features relevant to credit scoring. However, for Apollo Agriculture and Harvesting to leverage this technology, they had to have the right expertise on board to process and analyze satellite imagery. Ideally scientists should have experience working with a combination of:

- software engineering,

- machine learning/data science,

- remote sensing science, and

- agricultural and/or environmental science

These skills, neither easily available nor inexpensive to recruit, are key to building the infrastructure necessary to process thousands of images and develop the algorithms and tools that turn raw data into meaningful insights. FiDA’s case study also delves into the other components that Apollo and Harvesting had to have in place before embarking on their journeys, such as investment capital and training data.

Cost-effective customer acquisition is a challenging aspect of the business

There are potentially half a billion farmers who are not served by financial institutions and a decent chunk of them could be if we overcame information gaps. There is a huge demand for data and increasing availability of supply. That makes sense for a business case

Apollo and Harvesting strongly believe there is a business case in leveraging satellite imagery, even more so when an organization is utilizing satellite data at scale. But, in its business-to-consumer (B2C) model, Apollo has had to contend with the challenge of serving rural customers who are difficult and costly to reach. They have found that is it more difficult to recover customer acquisition costs for farmers with low-value loans.

Nevertheless, Apollo has demonstrated that with the use of satellite imagery, there is “ample room” for profitability at “imminently” achievable repayment rates. Harvesting points out that it’s a numbers game: using satellite imagery is ultimately cost-effective because the majority of the costs are fixed and, as an organization scales (with customers), those fixed costs remain, by and large, fixed.

FSPs must have a clear vision of why they want to leverage satellite imagery as well as realistic expectations of what the technology can achieve

[Satellite imagery] is sexy to put on a slide deck but if it’s not solving a problem, it’s a hammer in search of a nail. It’s hard and expensive and requires very specialized skills. Build your business without it if you can! Don’t do it because you think investors want to see it or conferences want to talk about it.

The most fundamental question an organization must ask is: what do we actually want to do with satellite imagery? The value of earth observation data depends on the existing data an organization utilizes and the additional value satellite imagery can provide given the high human capital cost of utilizing this technology. It would be prudent for organizations to first be sure of the benefit of satellite imagery and reflect on how the technology will enable them to reach their specific objective.

FiDA is confident that the journeys presented in this case study will provide a critical perspective on both the challenges and the promises of leveraging satellite imagery in financial services.